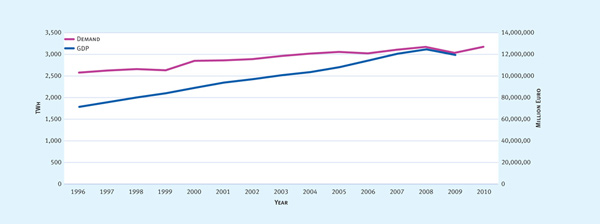

Demand Recovers

In 2010, electricity demand recovered in the EU-27, reaching 2008 – and thus pre-recession – levels. However, the recovery did not occur uniformly across Europe. In Germany and Spain, for instance, electricity demand increased compared to 2009 (by 5% and 3% respectively), but did not yet reach 2008 levels. In other cases demand rose to above pre-recession levels (Belgium saw a 11% increase over 2008). The trend of increasing electrification continues.

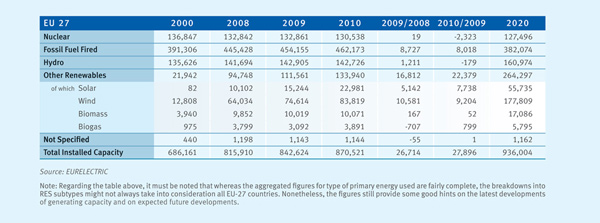

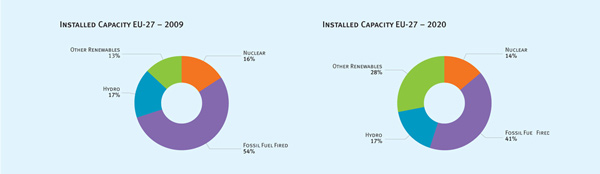

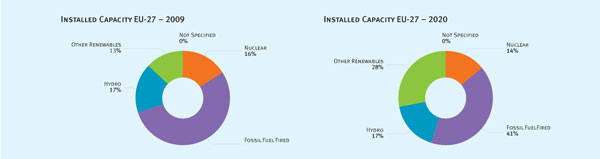

Capacity Increases

The EU’s total installed capacity continued to grow in 2010, reaching 870 GW – an increase of 28 GW, or 3%. Renewables other than hydro accounted for the fastest growing sources, with over 22 GW being connected to the grid; this accounts for more than three quarters of the newly installed capacity. As for nuclear capacity, about 2 GW were withdrawn from the grids, notably due to the closure of the Ignalina power plant in Lithuania. Fossil-fired capacity also grew, although only marginally, by 1.8%.

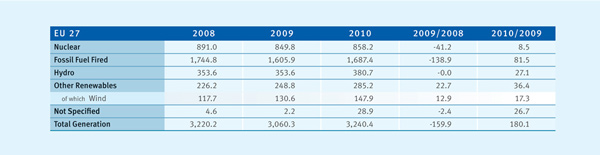

Generation Grows

All power generation technologies contributed to the increase in electricity generation. Renewables made up the lion’s share, sustained by good performance of hydro in southern Europe, due to favourable weather conditions in the reference period, and an increase of installed capacity for wind, solar and biomass. Hydro generation grew by 7%, other renewable energy sources (RES) generation by 14% compared to 2009 levels. Fossil-fired generation saw an increase of 5%, particularly in gas. The nuclear increase was smallest in comparison, with 1% above 2009 levels.

Variability Increases

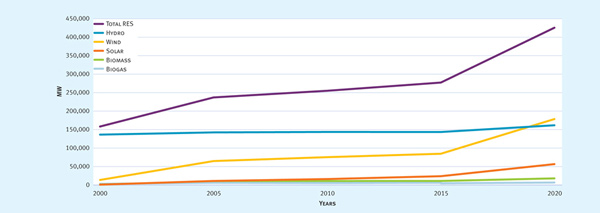

Data shows the increasing share of variable generation technologies in the power mix: wind increased from 74,614 MW to 83,819 MW between 2009 and 2010, and solar PV from 15,244 MW to 22,981 MW in the same period. Forecasts for future growth are even more spectacular. The gap between capacity and generation is therefore expanding, requiring ever more back-up capacity. This will be especially true up to 2020, since alternative and complementary means such as large-scale storage or demand-side measures are unlikely to deliver beforehand.

Technologies: Use them all!

Power was and will be generated using all available technologies. Power Statistics & Trends 2011 shows that the entire range of power generation technologies has been used, although the proportions have shifted over time. This diversified mix is crucial to ensure security of supply and to achieve an optimal balance between variable RES and flexible and back-up capacity.

The electricity industry has invested significantly in RES capacity

The electricity industry has taken on the challenge and has become a significant investor in ‘new’ RES (mainly wind, solar and biomass). With 276,666 MW in 2010, its capacity has nearly doubled since 2000. But for the industry to deliver in an optimal way – carbon-neutral, commercially viable, at affordable prices – a system approach has to be applied, developing both RES and back-up within an integrated European electricity market, which is yet to be set up.

New conventional capacity is required

There is an important need to replace ageing power plants in Europe in the next years. The Large Combustion Plant Directive, as well as the Industrial Emissions Directive will take many older plants out of the system within the next decade. Power Statistics & Trends 2011 reveals that the needed installation of new capacity is not taking place, apart from a limited switch to gas and a massive introduction of renewables as a result of generous support schemes. Incentives for setting up conventional capacity are lacking, and limited operation hours affect business cases just as negatively as regulatory uncertainty and insufficient remuneration.

Total CO2 emissions decrease, but specific emissions increase slightly

As a result of decreased electricity generation between 2008 and 2009, the power sector’s CO2 emissions fell further in 2009, from 1,186 GT CO2 to 1,127 GT CO2. However, the carbon intensity of the electricity industry – measured in grams of CO2 emitted per each kWh of electricity generated – increased slightly, from 368.4 g/kWh in 2008 to 369.7 g/kWh in 2009. A possible explanation could be the increasingly flexible operation of the fossil-fired fleet enforced by the deployment of variable RES. Faced with more frequent starts and stops as well as more frequent part-load operations, thermal power plants become less efficient and emit more CO2.

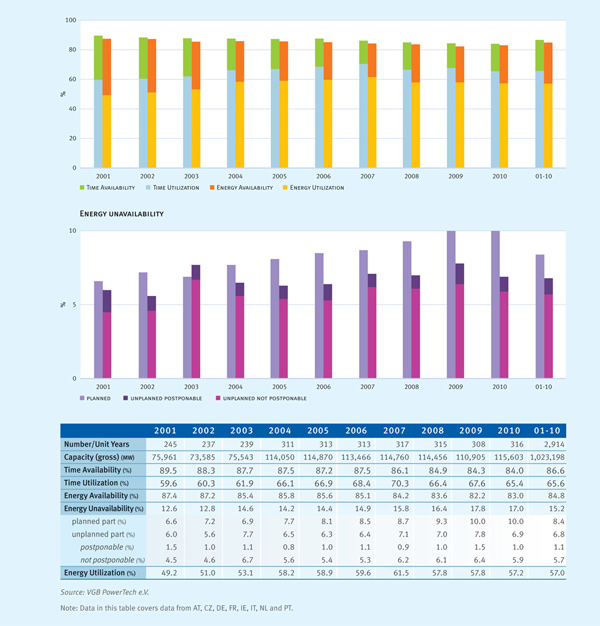

Conventional plants are less available – despite more maintenance

Availability of conventional power plants has deteriorated despite increased maintenance efforts. The analysis in this year’s special issue “availability/unavailability of conventional power plants” shows that the forced outage rate has increased over the last ten years even though maintenance has increased as well. The higher damage rate and maintenance needs can possibly be linked to the more flexible operation mode (i.e. part-loading) of the conventional fleet. Moreover, the EU power fleet is ageing: more than 70% of the conventional power fleet is older than 30 years. The economic viability of conventional generation is severely constrained by the lack of revenues for existing plants and the lack of incentives for replacing them.